Spectacular Tips About How To Reduce Wacc

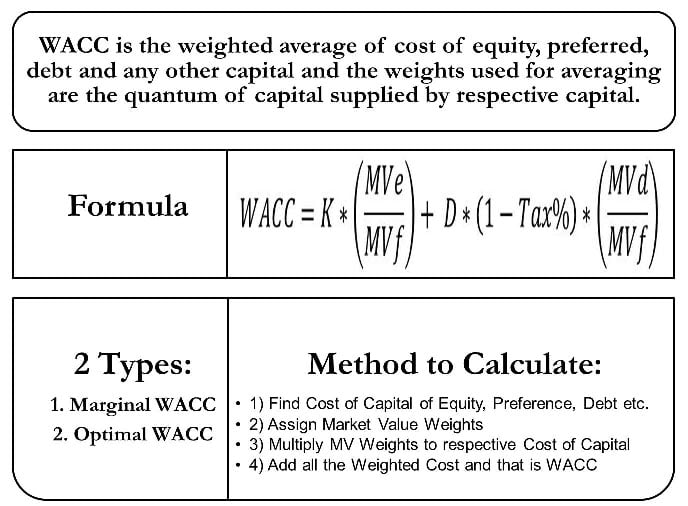

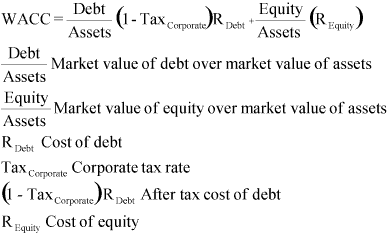

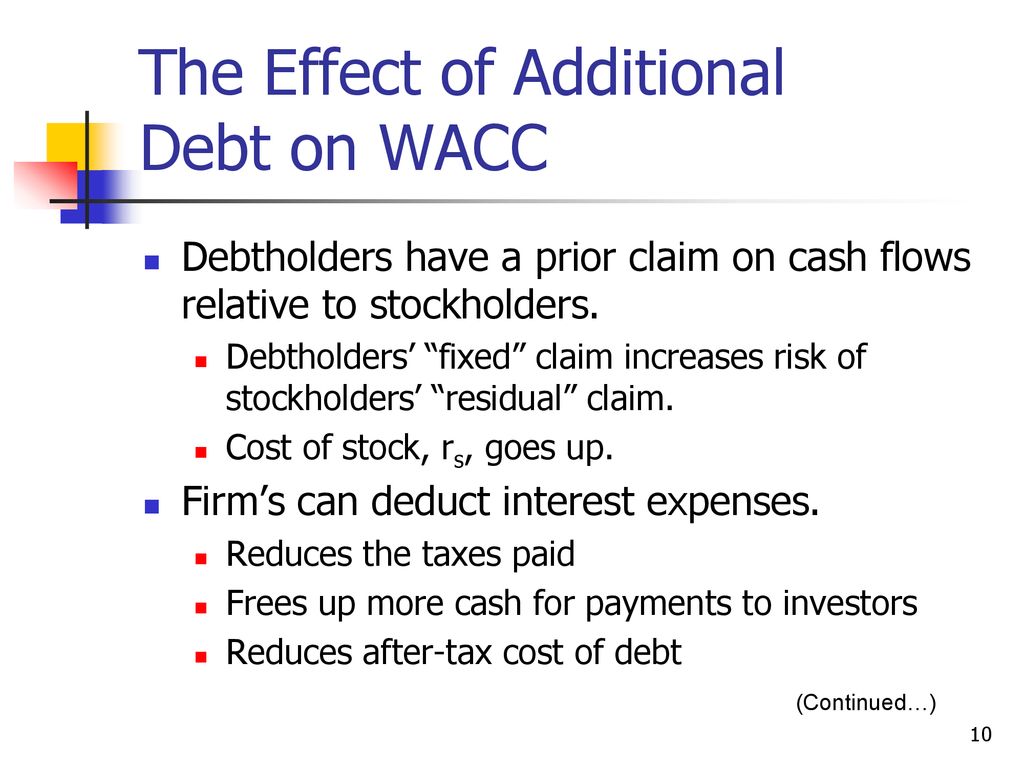

The cost of debt is adjusted lower in the wacc formula to reflect the company’s tax rate.

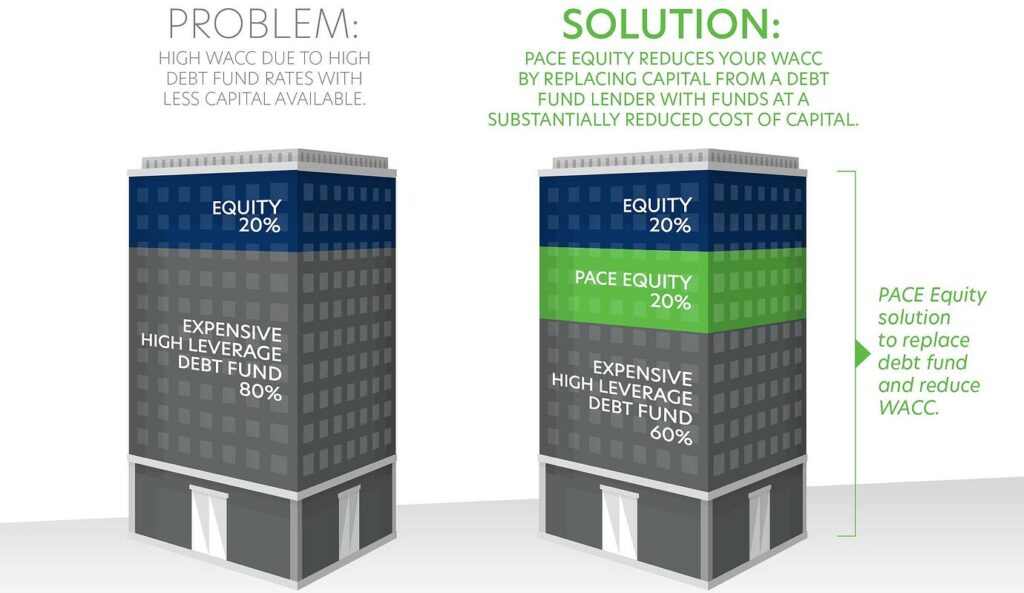

How to reduce wacc. This will increase the firm's leverage and reduce the cost of capital. (1) lower the cost of equity or (2) change the capital structure to include more debt. In conclusion, for a company that is on a steady growth trajectory, it makes sense to use available debt smartly to optimise its wacc and avoid further erosion of the founders’ equity position.

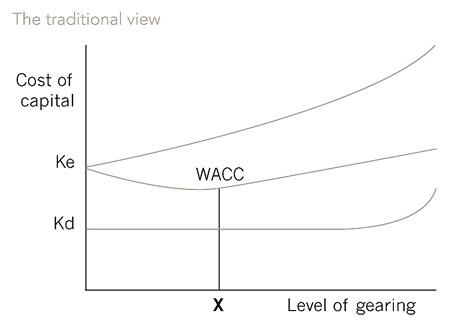

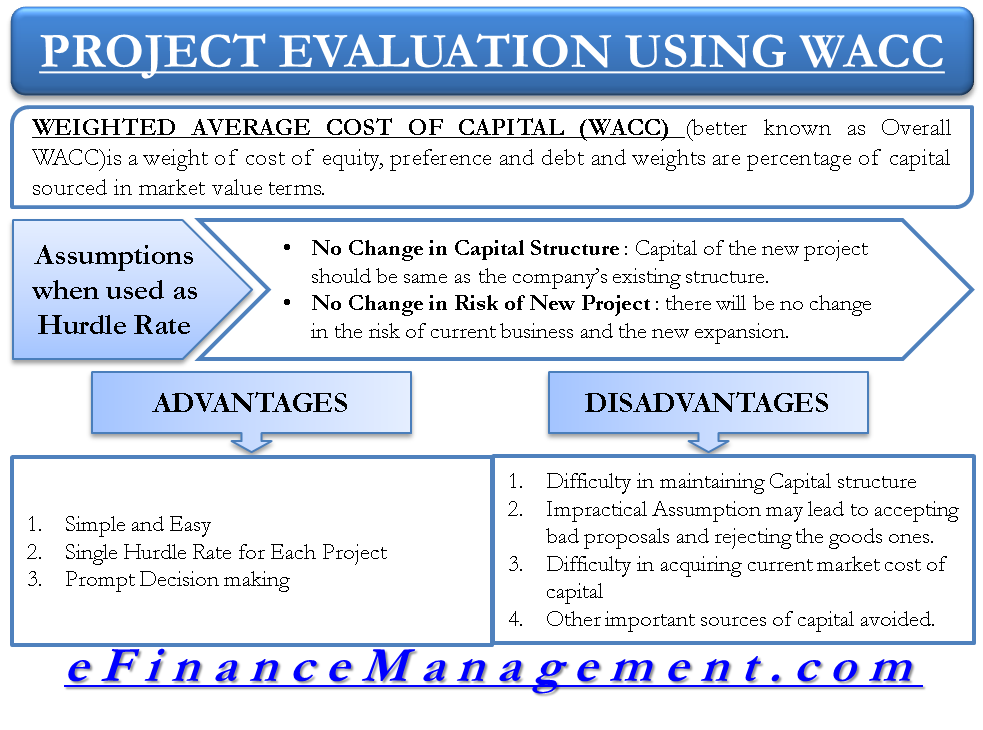

Answer:1) weighted average cost of capital is the combined rate at which a company repays borrowed capital. The response of wacc to economic conditions is more difficult to evaluate. The wacc is used instead for a firm with debt.

Equity costs equity cost is the return on investments that shareholders. It is better for the company when the. The value will always be cheaper because it takes a weighted average of the equity and debt rates (and debt financing is.

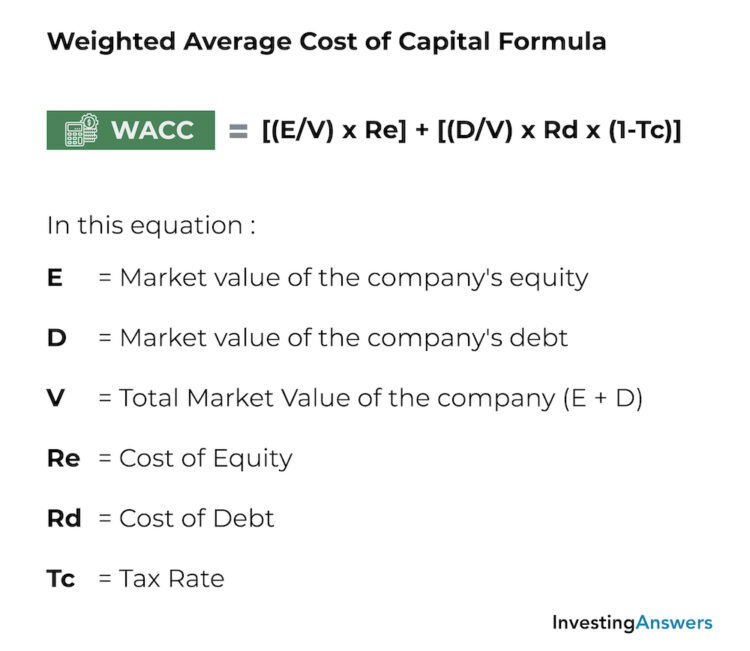

Beginning by assembling a checklist of all your lendings as well as bank card as well as how. We’ll break down the wacc formula and show you how to use it in the next few sections. In some cases, preferred equity.

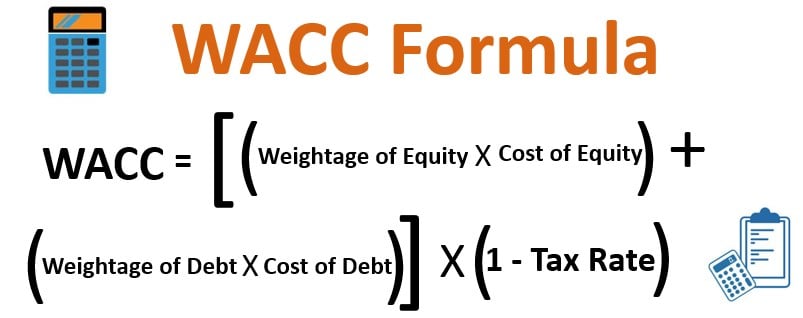

A company’s total cost of capital is often. What is the wacc formula? A company can reduce its wacc by cutting debt financing costs, lowering equity costs and capital restructuring.

E = market value of the firm’s equity d = market value of the firm’s debt v = e + d r e = cost of equity r d = cost of. The weighted average cost of capital (wacc). To reduce cost of capital, financial managers typically choose the methods of raising funds that cost the least to the company.

/TermDefinitions_wacc_FINAL-614b6b6efaa2493186484ab21ff31676.png)